Lower income seniors renting in the private market may be eligible for a rent supplement through SAFER.

About the SAFER program

The Shelter Aid for Elderly Renters (SAFER) program helps make rents affordable for BC seniors with low to moderate incomes. SAFER provides monthly cash payments to subsidize rents for eligible BC residents who are age 60 or over. Existing clients need to reapply each year.

Find out how much rent help you could get. Get an estimate.

Rental Assistance Program Calculator

SAFER application documents and resources

- SAFER Application Form

- SAFER Application Checklist

- SAFER Brochure

- SAFER Direct Deposit

- SAFER Income Verification form

SAFER eligibility

Am I eligible?

You may be eligible for the SAFER Program if you meet all of the following

- You are age 60 or older

- Your gross monthly income is less than $3,333.34 monthly or $40,000 annually

- You file an annual income tax return

- You have lived in BC for 12 months

- You pay more than 30% of your gross, before tax, monthly household income towards rent for your home. If you live in a trailer, this includes pad rental (manufactured home) that you own and live in

- You and your spouse, with whom you share a home, meet the Canadian citizenship requirements:

- Canadian citizen not under sponsorship*

- Individual lawfully admitted into Canada for permanent residence and not under sponsorship*

- Refugee sponsored by the Government of Canada

- Individual who has applied for refugee status

- Ukrainians in Canada under the Canada-Ukrainian Authorization for Emergency Travel (CUAET) visa

- * ”Sponsorship” means someone other than the Government of Canada helped you come to Canada and signed a sponsorship agreement. This rule does not apply to dependent children who are listed on the application with their caregiver or sponsor. May also be waived if BC Housing has accepted that the sponsorship has broken down.

You will NOT be eligible for the SAFER program

- You live in subsidized housing

- You live in a residential care facility funded by the Ministry of Health

- You live in co-operative housing and are a shareholder

- You or your family receive income assistance through the BC Employment and Assistance Act or disability assistance through the Employment and Assistance for Persons with Disabilities Act. Exception: You may be eligible if you have documentation of your income or disability assistance ending and you are only receiving Medical Services funding (Medical Services Only (MSO))

- Your gross monthly income exceeds $3,333.33 monthly or $40,000 annually

Step 1 – Complete a SAFER application

- There are three ways to get an application form:

- Online: Download an SAFER Application Form

- By mail: To have an application mailed to you:

- Complete this online request form, or

- call 604-433-2218 or 1-800-257-7756

- In Person: Pick up an application at the nearest BC Housing office, during office hours

Step 2 – Attach supporting documents

- Review the sections below or download the "SAFER Application Checklist" for information about the supporting documents to include with your application.

Proof of income

When applying for the Shelter Aid For Elderly Renters (SAFER) program, you will need to provide proof of income.

Tax Information

You must submit tax information for yourself and your spouse (if applicable) to determine your eligibility and possible benefit amount.

There are two ways that you can provide your tax information:

- Provide consent for Canada Revenue Agency (CRA) to release to BC Housing information from your tax records. Consent can be provided by completing the SAFER Income Verification Request Form; or

- Provide copies of both:

- Last year's Income Tax Return - An Income Tax Return Form is an official document on which one is required to list income amounts, deductions, contributions and related financial information for tax reasons.

- Income Tax Notice of Assessment - A Notice of Assessment (example) (T451) acts as proof of Canada Revenue Agencies’ confirmation of the given year’s income

- Log into your CRA My Account and print your assessment; or

- Call CRA at 1-800-959-8281 to request a Proof of income statement.

Proof of current gross monthly income

If any income reported on last year’s Income Tax Return has stopped or permanently decreased, please provide proof of current gross monthly income from all sources. Acceptable proof could include:

- Cheques or cheque stubs (must show gross amount and deductions)

- Letter from employer

- Bank statements showing direct deposits

- Other income statement(s)

Self-Employment or business income (if applicable)

If your household income from last year included income from self employment, please provide a copy of Income and Expenses (T2124 - Statement of Business Activities) from last year’s Income Tax return.

If last year’s annual income included income from self employment, please provide a copy of Income and Expenses (T2125 - Statement of Business or Professional Activities) and all related worksheets.

Proof of age and residency

Identification showing your date of birth and status in Canada is required for the applicant and their spouse (if applicable).

If you are receiving Old Age Security, attach a copy of one of the following:

- Birth or baptismal certificate

- Passport

- Driver’s License

- BC ID Card

If you are not in receipt of Old Age Security, please attach:

If born in Canada,

- Copy of Canadian birth or baptismal certificate

- Passport

If not born in Canada, please provide documentation showing date of birth as well as your status in Canada and that you are not under sponsorship. Examples could include copies of:

- Permanent Residence card

- Confirmation of Permanent Residence form

- Record of Landing

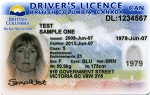

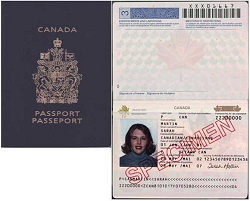

Samples of common documents:

Birth or Baptismal Certificate: If you cannot find your birth certificate, contact Service Canada for your province or territory of birth to obtain a copy. Visit the Service Canada website to find the appropriate website for your province or territory.

Driver’s Licence - For those that have a driver's licence, please provide a photocopy.

Passport - For those that have a passport, please provide a photocopy.

Confirmation of Permanent Residence form

Proof of rent

Please provide a copy of one (1) of the following as proof of monthly rent:

- Your Tenancy Agreement. It may be in a form from the Residential Tenancy Branch of B.C. or another form

- If your tenancy agreement is more than 12 months old, we also require one additional item from this list

- Recent notice of rent increase

- Rent receipt (no more than three months old) confirming:

- Your name, rental amount, and address

- Date

- Landlord's name, telephone number, and signature

- Recent rent cheque cleared by your bank

- Copy must show the front and back

- Must be stamped by the bank

If you are unable to provide one of the rent proofs listed above, please:

- Have your landlord, building manager or building owner complete the Landlord Declaration section on page 7 of the SAFER application form; or

- contact SAFER at 604-433-2218 or 1-800-257-7756 to discuss options

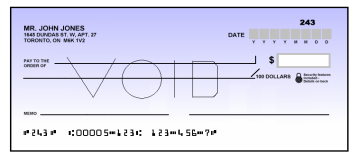

Bank information for direct deposit

SAFER payments are made by direct deposit.

Please attach one of the following

- a VOID cheque; or

- a Preauthorized Debit form provided by your bank; or

- SAFER - Direct Deposit Form completed by your bank. Form is also included as page 7 of the SAFER Application Form.

An acceptable VOID cheque must be personalized by the bank. We will not accept cheques with hand-written information.

Step 3 – Submit your SAFER application

You can submit your application and supporting documents in the following ways:

- Online: Scan and save, then submit using: Program Upload Form

- In person: Drop off to the nearest BC Housing office

- By fax: 604-439-4729

- By mail: SAFER, BC Housing, 101-4555 Kingsway, Burnaby, BC, V5H 4V8

Please do not include any original supporting documents, only copies.

Once we process your application, we will contact you to let you know if you are approved, ineligible or if we need more information to complete processing.

Frequently asked questions

Application questions

How will I know if my SAFER application is approved?

BC Housing will contact you by mail.

How is the rent subsidy calculated if I pay room and board?

If two or more meals per day, care, or personal services are included in the Rent amount, the Recipient is considered to be paying Room and Board. Rent is to be paid equal to fifty per cent of the total amount paid for Room and Board, regardless of the actual amount paid for the room portion.

Eligibility questions

May I apply for the SAFER rent subsidy if I am in a Long-Term Care facility or in a residence that is subsidized through another government agency?

No. Seniors residing in a Long-Term Care facility or in a residence that is subsidized through another government agency are not eligible for subsidy.

I received a T5007 Tax Slip from the BC Bus Pass Program and/or the Provincial Seniors Supplement. Does this impact SAFER eligibility or benefit amounts?

No. Being in receipt of the bus pass or seniors supplement does not impact eligibility for SAFER or the SAFER benefit amount. However, we ask that you provide a copy of the T5007 tax slip with your application or reapplication so that we can exclude this amount from your income.

What is the Maximum Rent Ceiling?

The maximum rent ceiling as of April 2025 is $1150.00 for both singles and couples in all communities across BC.

Program & payment questions

How is the SAFER subsidy paid?

Assistance is paid by direct deposit to your bank account on the last working day of the month. You will need to provide us with a VOID cheque or a Preauthorized Debit Form from your bank. If you do not currently have a bank account, you will need to open one.

When will my SAFER subsidy start?

If you are eligible, your subsidy will start the month your application is received in our office. For example, if an application is received on July 29, it will start the month of July. The SAFER subsidy is paid in arrears, meaning the July payment will be made at the end of the month.

Is there a minimum amount that SAFER will pay me?

Yes, the minimum is $50 per month.

What if I need to change my bank information?

You can change your bank information by forwarding BC Housing a copy of a blank cheque marked "void" or a pre-authorized debit form completed by your bank.

What if I am unable to use direct deposit?

Please call us directly: 604-433-2218 or (outside Metro Vancouver) 1-800-257-7756.

Do I ever need to reapply for SAFER?

Yes. Each year a reapplication form will be sent to you three months before your birthday. You must complete and return the reapplication to continue getting a subsidy.

I received a rent increase, what do I do?

Please forward a copy of the rent increase notice to the SAFER office. Your file will be updated and, if applicable, your subsidy adjusted.

Please note, if your rent is over the maximum allowable rent ceiling you may not receive an increase to your subsidy. Knowing your actual rent amount is important for us. This way we can better understand rental conditions when we later review the SAFER program.

I am moving, how do I get my subsidy transferred?

Contact the SAFER office immediately. The SAFER office will also require that you forward by mail a copy of your tenancy agreement or other proof of tenancy and rent. Please be prepared to provide the following information:

- Effective date of move

- New address

- New rent amount

- New landlord's name and contact information

- Details on anyone who will be living with you at the new address (if applicable)

My income changed; do I need to let you know?

Please inform BC Housing immediately so that we can make any necessary changes to your file. This does not include the cost-of-living increases to income such as Canada Pension Plan (CPP) or OAS.

Do I declare my SAFER subsidy on my annual income tax return?

Yes. SAFER is a non-taxable rent benefit but must be declared on your taxes if you receive more than $500 in a tax year. BC Housing will issue a T5007 – Statement of Benefits if required.

Do you have a question? Talk to someone at BC Housing. Call 604-433-2218 or 1-800-257-7756.