About the RAP program

The Rental Assistance Program provides eligible low-income families with monthly assistance to help with their monthly rent payments.

To qualify, families must have a total before-tax household income of $60,000 or less and have at least one dependent child. Existing clients need to reapply each year.

Find out how much rent help you could get. Get an estimate.

Rental Assistance Program Calculator

RAP application documents and resources

- RAP Application Form

- RAP Application Checklist

- RAP Brochure

- RAP Direct Deposit

- RAP Income Verification Request Form

RAP eligibility

Am I eligible?

You may be eligible for the Rental Assistance Program if you meet all of the following

- You have a total before-tax annual household income of $60,000 or less

- You have at least one dependent child. A dependent child is unmarried, a stepchild, adopted child or legal ward, mainly supported by you

- Dependent children are:

- under 19 years of age, or

- under 25 years of age and are full-time students at a secondary school, university or vocational institute. Education providers must be a recognized place of study that grants diplomas certificates or degrees, or

- of any age, because of a mental or physical disability as defined by Canada Revenue Agency

- You have less than $100,000 in assets

- You file an annual income tax return

- You do not receive income or disability assistance through the B.C. Employment and Assistance Act or the Employment and Assistance for Persons with Disabilities Act. Exception: You may be eligible if you have documentation of your income or disability assistance ending and you are only receiving Medical Services funding (Medical Services Only (MSO))

- More than 30% of your household income goes towards household rent or pad rental for a manufactured home or trailer that you own and occupy

- You have lived in BC for 12 months

- You meet the program residency requirements:

- Canadian citizen not under sponsorship*

- Individual lawfully admitted into Canada for permanent residence and not under sponsorship*

- Refugee sponsored by the Government of Canada

- Individual who has applied for refugee status

- Ukrainians in Canada under the Canada-Ukrainian Authorization for Emergency Travel (CUAET) visa

- * “Sponsorship” means someone other than the Government of Canada helped you come to Canada and signed a sponsorship agreement. This rule does not apply to dependent children who are listed on the application with their caregiver or sponsor. May also be waived if BC Housing has accepted that the sponsorship has broken down

You will NOT be eligible for the RAP program

- You live in subsidized housing

- You are a shareholder living in co-operative housing

- You or a member of your family do not meet the residency requirements

- You or your family get income assistance under the BC Employment and Assistance Act or the Employment and Assistance for Persons with Disabilities Act. Exception: You may be eligible if you have documentation of your income or disability assistance ending and you are only receiving Medical Services funding (Medical Services Only (MSO))

- Your annual total household income before taxes is over $60,000

- You have more than $100,000 in assets

- You share a kitchen or bathroom with the homeowner/landlord

Step 1 - Complete RAP application

There are three ways to get an application form for the Rental Assistance Program:

- Online: Download a Rental Assistance Program (RAP) Application Form

- By mail: To have an application mailed to you:

- Complete this online request form, or

- Call 604-433-2218 or 1-800-257-7756

- In Person: Pick up an application at the nearest BC Housing office, during office hours

Step 2 - Attach supporting documents

Review the sections below or This section corresponds to the "Rental Assistance Program (RAP) Application Checklist" for more information about the supporting documents to include with your application.

Proof of income

There are two ways that you can provide your proof of income:

- Provide consent for Canada Revenue Agency (CRA) to release to BC Housing information from your tax records. Consent can be provided by completing the Rental Assistance Program (RAP)Income Verification Request form

- Provide copies of both last year's Income Tax Return (T1) and Notice of Assessment from Canada Revenue Agency (CRA)

If you are not providing CRA consent and do not have your tax return and Notice of Assessment, you can log into your Revenue Agency account at www.cra.gc.ca/myaccount and print your assessment or call CRA at 1-800-959-8281 or 1-800-959-8281 to ask for a Proof of Income Statement.

Additional Income documents

Provide a copy of any additional income documents that may apply to your situation:

Self Employment:

If you or your spouse reported income from self employment or business activities on last year’s Income Tax return, please attach a copy of the Statement of Business Activities (T2125) that was filed with your tax return

Non-Taxable Income:

If you or your spouse receive any regular ongoing income from non taxable sources, please attach a cheque stub, bank statement, or other confirmation – that shows direct deposit or payment to you from any other sources. This includes pensions

Current Income:

If any income reported on last year’s Income Tax Return has stopped or permanently decreased, please provide proof of current gross monthly income from all sources. Acceptable proof could include:

- Cheques or cheque stubs (must show gross amount and deductions)

- Letter from employer

- Bank statements showing direct deposits

- Other income statement(s)

Proof of status in Canada

All members of the household must be a Canadian citizen, a permanent resident or a refugee claimant. Provide a photocopy of any documents that apply, for you and for every family member.

- Born in Canada

- Canadian birth certificate – If you were born in Canada

- Note: If you are unable to find your birth certificate, you will need to contact Service Canada for the province or territory of your birth to obtain a copy. To find the website for your province or territory please visit the Service Canada website

- Born to Canadian parent(s) outside of Canada

- Certificate of Registration of Birth Abroad or long form Certificate of Canadian Citizenship – If you were born outside Canada to parent(s) who were Canadian citizens at the time of your birth

- Permanent Resident

- Immigration Record of Landing – If you arrived before June 28, 2002, the Immigration Record of Landing (or IMM 1000) is a paper document that verifies permanent resident status

- Confirmation of Permanent Residence – If you arrived after June 28, 2002, the Confirmation of Permanent Residence (IMM 5292) is a paper document that verifies permanent resident status

- Permanent Resident (PR) card – If you arrived after December 31, 2003, the PR card is a small, plastic, status card. It replaces the paper IMM 1000 and verifies permanent resident status

- Refugee

- Refugee claimant document – If you are government-sponsored refugees or have claimed refugee status

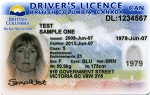

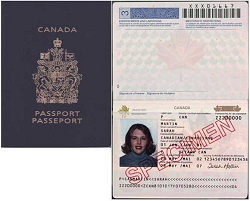

Samples of common documents:

Birth or Baptismal Certificate: If you cannot find your birth certificate, contact Service Canada for your province or territory of birth to obtain a copy. Visit the Service Canada website to find the appropriate website for your province or territory

Driver’s Licence - For those that have a driver's licence, please provide a photocopy

Passport - For those that have a passport, please provide a photocopy

Confirmation of Permanent Residence form

Proof of rent

Provide a copy of (1) of the following as proof of monthly rent:

- Your Tenancy Agreement – it may be a form from the Residential Tenancy Branch of B.C. or another form

- If your tenancy agreement is more than 12 months old, we also require one additional item from this list

- Recent notice of rent increase

- Rent receipt (no more than three months old) confirming:

- Your name, rental amount and address

- Date

- Landlord’s name, telephone number and signature

- Recent rent cheque cleared by the bank

- Copy must show front and back

- Must be stamped by the bank

If you are unable to provide one of the rent proofs listed above, contact the Rental Assistance Program office at 604-433-2218 or 1-800-257-7756 to discuss options.

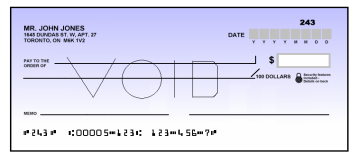

Bank information for direct deposit

Rental Assistance Program payments are made by direct deposit. If you do not currently have a bank account, you will need to open one.

Please attached one of the following:

- A VOID cheque; or a Preauthorized Debit form provided by your bank; or

- Rental Assistance Program – Direct Deposit Form, completed by your bank. Also included as page 8 of the Application form

An acceptable VOID cheque must be personalized by the bank. We will not accept cheques with hand-written information.

Proof of assets

Provide a copy of any of the following documents that apply for yourself and your spouse:

- A bank statement from a financial institution (such as a bank, credit union) that shows the total value your chequing and savings accounts for a 30-day period

- A letter from a financial institution(s) that shows the total value of any other assets or financial holdings

- A recent Property Assessment Notice from BC Assessment, or a land title search showing the value of your property and proof of outstanding mortgage, if you own a rental property or other real estate

Proof of student status

- Children aged 19 to 24 in full time attendance at a school, university or vocational institution must provide proof of enrolment

Step 3 - Submit your RAP application

You can submit your application and supporting documents in the following ways:

- Online: Scan and save, then submit using: Program Upload Form

- In person: Drop off to the nearest BC Housing office

- By fax: 604-439-4729

- By mail: Rental Assistance Program, BC Housing, 101-4555 Kingsway, Burnaby, BC, V5H 4V8

Please do not include any original documents, only copies.

Once we process your application we will contact you to let you know if you are approved, ineligible or if we need more information to complete processing.

Frequently asked questions

General questions

- What are the Maximum Rent Ceilings?

Effective April 2025:- Family of 3 or less $1,950, province wide

- Family of 4 or more $2,200, province wide

What happens if my documents have been lost or stolen?

If any of your residency documents have been lost, stolen or destroyed you need to contact Citizenship and Immigration Canada or call 1-888-242-2100. You will need to download and fill out the application (IMM5545) and mail your completed application to the nearest Citizenship and Immigration Centre near you.

How is my information used and protected?

BC Housing only collects information from applicants applying for the Rental Assistance Program in accordance with Section 26c of the Freedom of Information and Protection of Privacy Act (the FOI Act). We do not disclose your information to other public bodies or individuals except as authorized by law. We keep the information only for the length of time necessary to fulfil the purpose(s) for which it was collected.

If you have questions about the collection or use of your information, please call 604-433-1711 and ask to speak to BC Housing’s FOI Officer or email to [email protected].

Applicant questions

What if I haven't filed an income tax return?

Filing an income tax return is a requirement of the program. If you or your spouse has not filed a tax return you may not be eligible.

I’ve filed my Tax Return, but Canada Revenue Agency hasn't processed it yet. Can I still submit my application?

Yes. Once your application has been received by BC Housing, you will have up to 90 days to gather and submit any missing information.

Do I declare my rental assistance on my annual income tax return?

Yes. Rental assistance is a non-taxable rent benefit but must be declared on your taxes if you receive more than $500 in a tax year. BC Housing will issue a T5007 – Statement of Benefits.

Why should I provide consent for Canada Revenue Agency to release income tax records to BC Housing?

Providing consent is optional. If you choose to provide consent it will streamline the application and annual reapplication process as you will not need to gather and submit your income tax documents.

Who is considered a dependent child?

Under the Rental Assistance Program, dependent status is considered when a child is:

- under 19 years of age;

- under 25 and registered in full-time school, university or vocational institute which provides a recognized diploma, certificate or degree;

- of any age who, because of mental or physical infirmity, is accepted as a dependent for income tax purposes

What if I have children 19 years or older living with me who are not considered dependent or I share with someone who is not part of my immediate family?

If there are other adults living in the rental unit you will need to provide information on how much they are paying towards the full rent and this amount will be used when calculating your portion of the rent and the assistance through the program.

My minor child (under age 19) has a part-time job; do I need to declare their income?

No, the assistance through the program is based on the income of yourself and your spouse (if applicable).

- What counts towards the $100,000 asset ceiling?

- Real estate / property (within Canada or overseas)

- Stocks/ bonds/ term deposits/ mutual funds / shares

- Cash

- Business equity - equity value in private incorporated company of cash, GIC’s bonds, stocks or real estate held by company

- What doesn't count towards the $100,000 asset ceiling?

- Vehicles

- Registered Education Savings Plans (RESPs), Registered Retirement Savings Plans (RRSPs) and Registered Disability Savings Plans (RDSP)

- Personal effects; e.g. vehicles, jewellery, furniture

- Trade and business tools essential to continue currently active employment; e.g. farm equipment, vehicle

- Asset Development Accounts; savings programs that are designed to assist individuals to achieve savings for the purposes of future self-sufficiency or future enhanced self-sufficiency. Such assets are excluded for the period that the applicant is participating in the asset development account program

- Assets derived from compensatory packages from government (examples include: Indian Residential School Settlements and Japanese Canadian Redress)

Eligibility questions

What happens if my income changes?

The assistance is based on your previous year’s income. Fluctuations throughout the year will be captured on your next income tax return and will be reflected in the amount you receive in the future. If your income has significantly and permanently gone down, please contact us to determine if you are eligible for an adjustment.

What if my income was over the maximum income on last year’s tax return, but my income has gone down?

Please submit to the office:

- Details of why and when your income changed; and

- Proof of all current gross monthly income, from all sources

Once the information is received, we will review and let you know if we need more information and if you are eligible for an adjustment to the assistance.

Is there a minimum income to be eligible?

The benefit is a reimbursement for rent paid and you must be able to provide evidence of how you have paid, or plan to pay, the rent if your income is less than or close to the full rent amount.

What happens if I go on income assistance?

You must notify us immediately at 604-433-2218 or 1-800-257-7756 outside the Lower Mainland. Failure to advise BC Housing that you are receiving income assistance will result in a debt that will need to be repaid.

What are the residency requirements?

You must live have lived in British Columbia for at least the last 12 months. Everyone in the household must be one of the following:

- Canadian citizen not under sponsorship*

- Individual lawfully admitted into Canada for permanent residence and not under sponsorship*

- Refugee sponsored by the Government of Canada

- Individual who has applied for refugee status

- Ukrainians in Canada under the Canada-Ukrainian Authorization for Emergency Travel (CUAET) visa

Note:

* ” Sponsorship” means someone other than the Government of Canada helped you come to Canada and signed a sponsorship agreement. This rule does not apply to dependent children who are listed on the application with their caregiver or sponsor. May also be waived if BC Housing has accepted that the sponsorship has broken down.

Program & payment questions

What if I need to change my bank information?

Please submit a new VOID cheque or equivalent. See Section B: Bank account information in Attach Supporting Documents.

What if I do not have a bank account for direct deposit?

The assistance is only paid by direct deposit to your bank account. If you do not currently have a bank account, you will need to open one.

Do I have to be off income assistance for any period of time before I can apply to the Rental Assistance Program?

There is no time limit for being off of income assistance before you are eligible to apply for the Rental Assistance Program. To be eligible and apply for the Rental Assistance Program you will need to provide official documentation confirming the last day that you will receive an income assistance payment.

However, if you are receiving help from the Rental Assistance Program and have to go back on Income Assistance or Disability Assistance you must notify us immediately at 604-433-2218 or 1-800-257-7756 outside the Lower Mainland.

If you receive any Rental Assistance payments while receiving Income Assistance or Disability Assistance your account will become suspended and any over payments will be owed to BC Housing and will need to be repaid.

What happens if I move or my rent amount changes?

Please inform BC Housing immediately so that we can make the necessary changes to your file and adjust your assistance accordingly. If your rent has decreased, you should contact BC Housing immediately to avoid over payments which you will be required to repay. If your rent has increased your assistance may increase if your rent is below the program maximum rent ceiling.

How is the rental assistance subsidy calculated?

The Rental Assistance Program reimburses a percentage of the difference 30 percent of your gross household income and your rent, subject to the maximum rent ceilings and maximum benefit amounts. Please see the program calculator.

How is the rental assistance paid?

The assistance is only paid by direct deposit to your bank account. Deposits are made on the last working day of each month. You will need to provide us with a VOID cheque or a Preauthorized Debit Form from your bank. If you do not currently have a bank account, you will need to open one.

How will I know the status of my Rental Assistance Program application?

BC Housing will contact you by mail.

When will my rental assistance be effective?

As long as you are eligible, your assistance will be effective the month we receive your application in our office. For example, if your application is received in our office on March 29, your application will be effective the month of March. The Rental Assistance Program pays in arrears; the payment made at the end of March is reimbursement for rent paid for the month of March.

If I begin to receive payments through the Rental Assistance Program will my application for subsidized housing be cancelled?

No. We encourage eligible families who have registered with The Housing Registry to apply to the Rental Assistance Program, as the Rental Assistance Program can provide some financial assistance while they are looking for more alternate housing.

If eligible for the program your application with The Housing Registry will remain active and will continue to be considered for units as they become available in the developments or areas selected. Once you receive a unit through The Housing Registry your Rental Assistance payments will stop.

Why am I not eligible for the Rental Assistance Program if I am receiving Income Assistance or Disability Assistance?

The Rental Assistance Program is a 'shelter' subsidy provided by the provincial government. Income assistance and disability assistance provided by the province also has a 'shelter' subsidy. You cannot receive two of the same form of subsidy from the government, so those receiving Income Assistance are not eligible unless their income assistance or disability assistance file has been closed (excluding Medical Services only).

If it is necessary for you to go onto income assistance or disability assistance, you will receive a shelter payment from income assistance and not from the Rental Assistance Program.

Do you have a question? Talk to someone at Rental Assistance Program. Call 604-433-2218 or 1-800-257-7756.